As we roll on into 2025, the economic view of the United States is starting to take shape. The labor market was erratic last year, leading the Federal Reserve to start dropping interest rates. After interest rates were dropped by the Fed, we saw a massive spike in mortgage rates for the last few months of 2024. Now, we’re starting to see some progress on mortgage rates, but the labor market remains weak going into 2024

Unemployment Up in 2024

The U.S. Bureau of Labor Statistics released its Unemployment summary for 2024, indiciating that unemployment rates were up in 21 states. Overall, the U.S. jobless rates increased by 0.4% in 2024 when compared to 2023. Federal Reserve Chairman Jerome Powell stated last year that part of the strategy of decreasing the interest rates were to help a “cooling” labor market. Indeed the labor market continued to cool throughout 2024, as interest rates made little to no impact on the state of the job market.

Rhode Island, South Carolina, and Colorado all saw the highest increase in unemployment in 2024. South Dakota saw the lowest unemployment rate at 1.8%, while Nevada had the highest at 5.6%.

Mortgage Rates Finally Drop

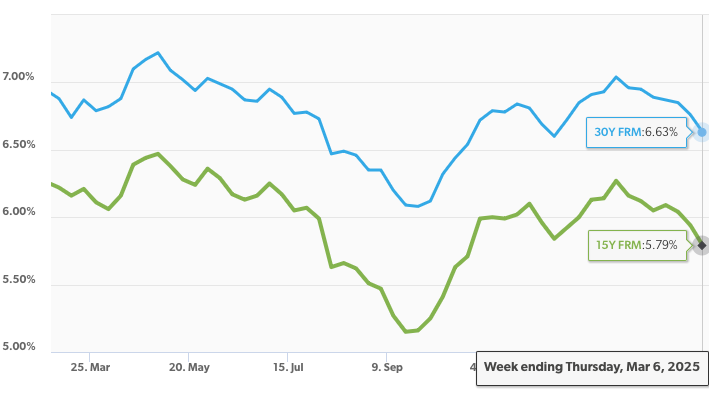

While the Federal Reserve cut interest rates in the second half of 2024, only to see rates go up shortly after. In January 2025, rates saw an eight-month high with mortgage rates spiking up to 7.04% for a 30-year mortgage. However, each week since then, we’ve seen interest rates drop. Today, mortgage rates sit at 6.63% for a 30-year mortgage, while 15-year loans sit around 5.79%.

Inflation has been jumping up over the last several months, which means likely that purchasing power has been decreasing.The demand for new home sales has finally slowed, and interest rate cuts from the Federal Reserve are finally catching up.

State of the Economy

We’ve seen continued inflation for the last several months, followed by dropping interest rates, and a volatile labor market. The United States economy looks to have a rebound, as the economy has been slowly growing (slower than average) over the last five years. We’re a few years passed the COVID crisis, and while the last few years, including 2025, have seen unstable economic policy, we’re waiting for a steady strong growth period in the United States. We will need to see the steady labor numbers, lower prices, and lower mortgage rates before we can say the economy is very strong, although some have argued that the growth of the United States is outpacing most of the world, and that in itself is a win.