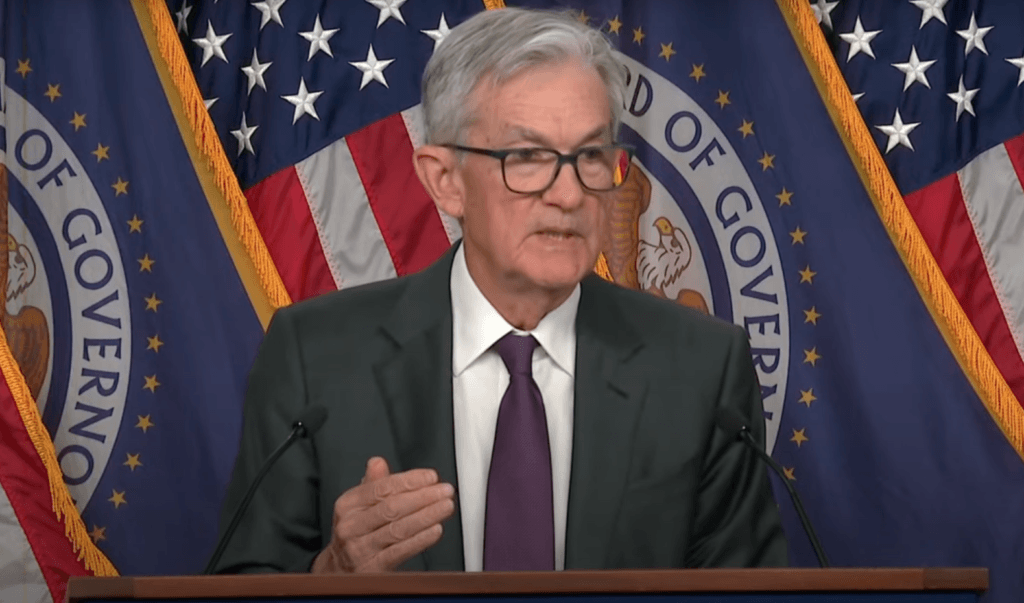

The Federal Reserve announced Wednesday, January 29th, that interest rates will stay at 4.25-4.5%. This move was expected as inflation has yet to stabilize.

The Announcement

The initial announcement came at 2pm EST through the Federal Reserve’s website, stating “Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated… In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent.”

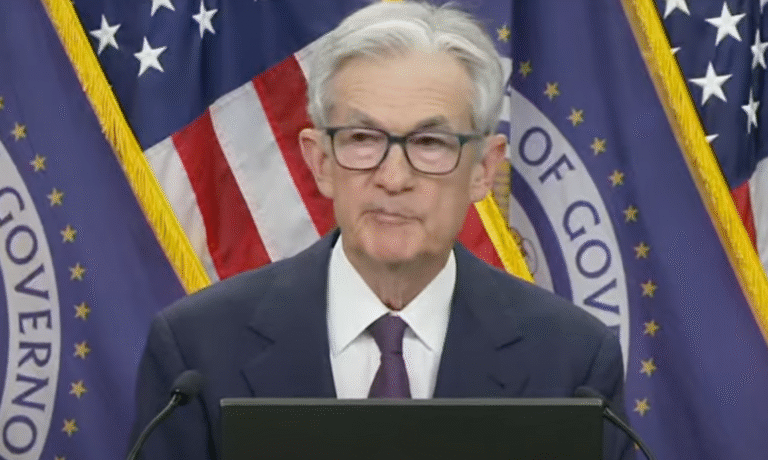

Jerome Powell, Federal Reserve Chairman, stated, “The economy is strong overall. And. we’ve made significant progress to our goals over the last two years. In support of our goals (of 2% inflation rates), the FOMC has decided to leave our interest rates where they are.” Powell stated that reducing policy too fast can hinder progress on inflation, while too slowly could weaken economic activity and unemployment. The goal is for the Federal Reserve to analyze the economy, and move accordingly.

The Economy

The economy has made improvements over the last two years as Powell stated today. However, while 2024 seemed to have some signs of good news for the U.S. economy, the job market was slow, and late 2024 saw increases in inflation after interest rates were dropped. The U.S. economy is far from being in a stable position to have lower interest rates, but economic activity is still moving slowly for many businesses and consumers.

Mortgage rates are high, and prices are still too high. Many have noticed the prices and their impact on American families over the last two years and demanded action. This was a major factor in the election of Donald Trump, and Trump has demanded that the Federal Reserve lower interest rates. The Federal Reserve, which is independent of the Executive Branch, does not have to and did not comply with the President’s demand. Instead, the Fed decided to take a slower approach. As Jerome Powell stated, if they move to slowly on lowering interest rates, they could stunt ecnomic growth. However, moving too quickly could cause prices to skyrocket, thereby forcing the Fed to move backwards on its decision making.

Mortgage Rates

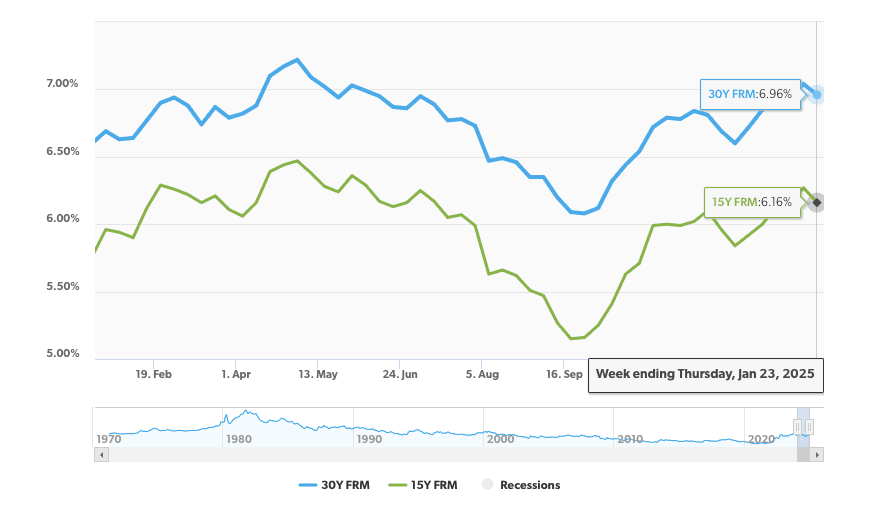

While the Federal Reserve dropped interest rates starting a few months ago, interest rates have been climbing ever since that date. It was in September when the Fed made its first moves, and while interest rates quickly dropped for mortgage rates, they took a sharp upturn in October. Mid-January saw an eight-month high of interest rates at 7.04% for 30-year mortgages. Potential homebuyers are still struggling to find quality mortgage rates that will fit their budget. Mortgage rates around 6-7% can add hundreds or even thousands more to a home that is $300k+, versus a rate less than 5%. This leaves potential homebuyers in a difficult position. Do they wait for mortgage rates to come down, but meanwhile home prices are going up? Or do they buy now, and refinance later at a lower mortgage rate?

Why It Matters

The economy does seem to be stabilizing, but it has been a slow process. Uneven economic policy has been a factor, and a major U.S. election has definitely made an impact. However, the U.S. economy often moves independently of politics, and instead is shaped by the free market and economic conditions of the world. American citizens are sitting on one of the stronger economies in the world, but there is still a lot of room for growth in the job market and price inflation. The Federal Reserve hopes to stabalize the economy with economic activity and interest rates. While Americans wait, prices remain relatively high along with overall interest and mortgage rates.