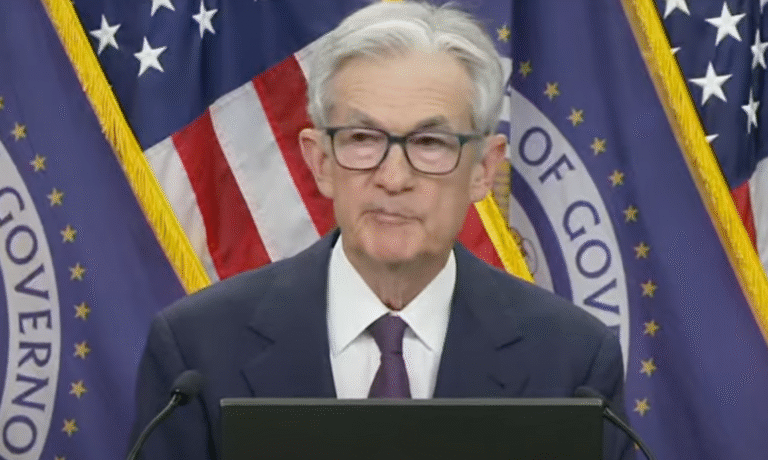

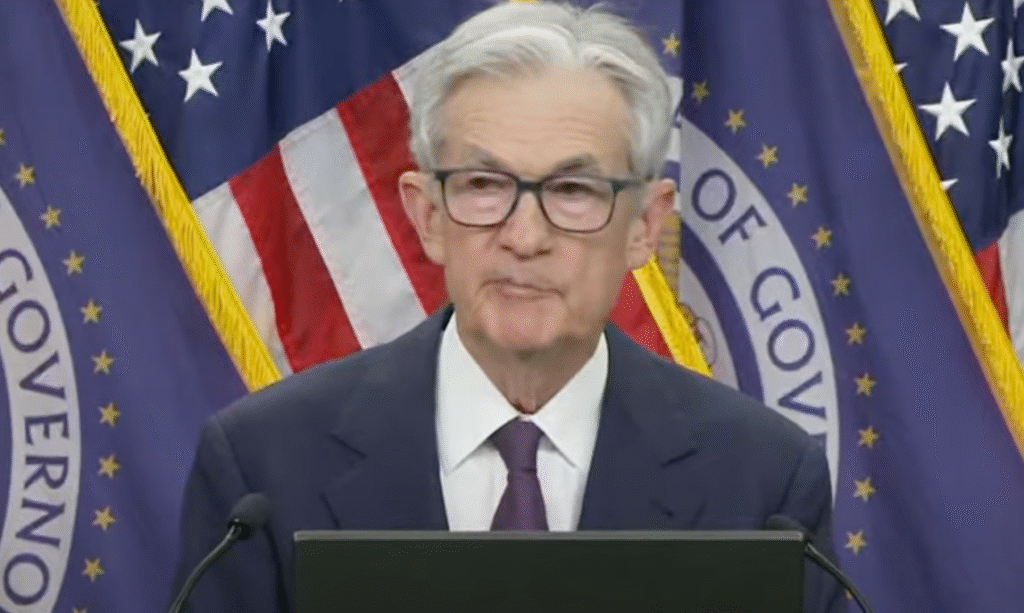

The Federal Reserve released its FOMC statement today, announcing that federal interest rates will remain at 4.25-4.5%. Fed Chair Jerome Powell addressed the media today to discuss the economic outlook of the United States.

“Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.”

Inflation and Tariffs

Latest reports on inflation have a 12-month unadjusted rate of 2.4%, which is slightly above the Fed’s 2% goal. Economic data is strong for the United States, but there remains caution of increased inflation, mainly due to tariffs.

While tariffs were not discussed in the official statement, Powell did follow up with the discussion after questions from reporters. When asked about the extent of tariffs and the timeline of their impacts, Powelled followed up: “We’ve had three months of favorable inflation readings.” He continued, “We’ve had goods inflation moving up just a bit. We do expect to see more of that over the course of the summer. It takes some time for tariffs to work their way through the chain of distribution to the end consumer.”

Employment

Employment has remained strong over the last few months, and in the statement, Powell stated that employment remains at or near maximum employment. Unemployment did “tick up a bit” to 4.2% in May, as the economy continued to add jobs, but the labor market continues to grow.

Employment is the second-largest factor that the Federal Reserve must consider when looking at interest rates. Higher interest rates mean that economic growth is somewhat slowed. This is intentional, as to keep demand lower, thereby keeping prices (inflation) low. However, if demand and prices remain low, then economic activity remains slow. With slower economic activity, we will usually see businesses tightening their employment, leading to slower hiring rates and potentional higher unemployment rates. If unemployment spikes, we will likely see a quick drop in interest rates.

Because the state of the economy is strong, money is being spent within the economy, and unemployment is low, there is little need or motivation for the Federal Reserve to drop interest rates. They can continue to work towards reducing inflation to 2% while economic activity remains strong. Moving the interest rates too quickly, they fear, will bump up economic activity and raise prices. This, coupled with the fear of tariff impacts, will cause the Federal Reserve will continue to be cautious about interest rates.

Find out more about finances at FreedomFinances.org.